Free Debt Payoff Calculator

Compare avalanche vs snowball strategies, see your payoff timeline, and discover how much interest you'll save. No signup required.

Debt Payoff Calculator

Compare strategies and see your debt-free date

Choose Strategy

Pay highest interest rate first. Mathematically saves the most money.

Pay smallest balance first. Builds momentum with quick wins.

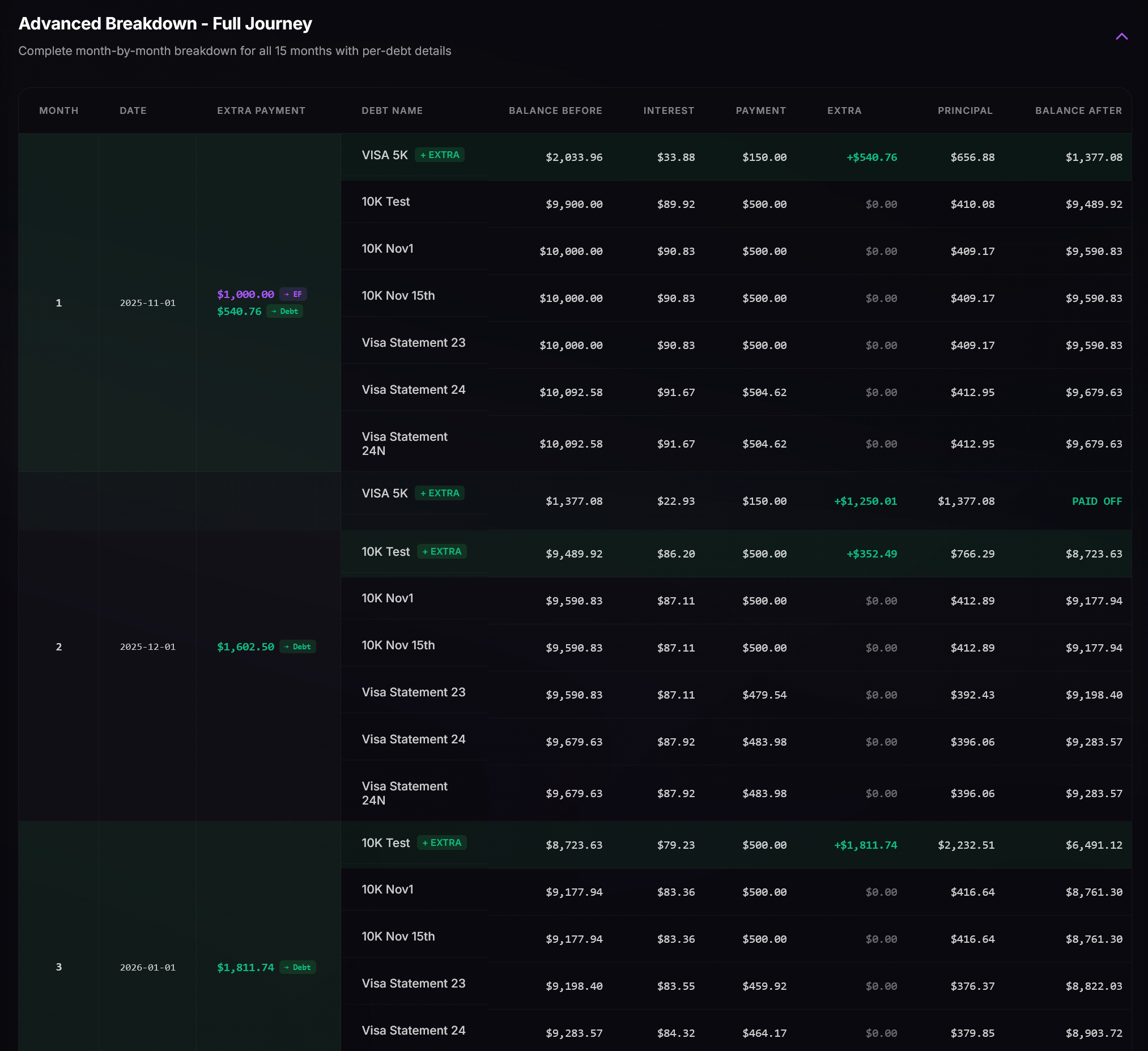

PAYOFF SUMMARY

Want to see every payment?

The app tracks it all for you.

Understanding Debt Payoff Strategies

Learn more about the methods behind the math

Debt Avalanche

Attack your highest interest rate debt first. Like an avalanche gaining momentum, you knock out expensive debts quickly, saving maximum money on interest. Best for disciplined savers who want to minimize total cost.

- Minimizes total interest paid

- Mathematically optimal

- Best long-term savings

Debt Snowball

Start with your smallest balance, regardless of interest rate. Each debt you eliminate builds psychological momentum, like a snowball rolling downhill. Best for those who need motivation and quick wins.

- Quick psychological wins

- Builds motivation

- Higher completion rates

Frequently Asked Questions

Disclaimer: This calculator is for educational purposes only and does not constitute financial advice. Results are projections based on the information you provide. Actual results may vary. Consult with a qualified financial advisor for personalized guidance.

Choose Strategy

Choose Strategy

PAYOFF SUMMARY

PAYOFF SUMMARY

Understanding Debt Payoff Strategies

Understanding Debt Payoff Strategies